And given continued responsible use of the two cards and a history of on-time payments, the negative effects of a new credit card are typically temporary. Since the new card’s credit limit adds to your overall available credit limit, you may ultimately benefit from a better credit utilization ratio.

However, there are some potential benefits to applying for a balance transfer card too. Finally, you also run the risk of accumulating additional debt you find hard to repay, which will only have a detrimental effect on your creditworthiness. The effect might be particularly pronounced if you have no more than one or two cards. Adding a new card to the mix brings down the average age of your credit accounts, which will also negatively affect your credit score. The application for a new credit card involves a hard credit inquiry that will cause your credit score to drop by a few points in the short term. However, keep in mind that a balance transfer might impact your credit score.

CHASE CREDIT JOURNEY FREE

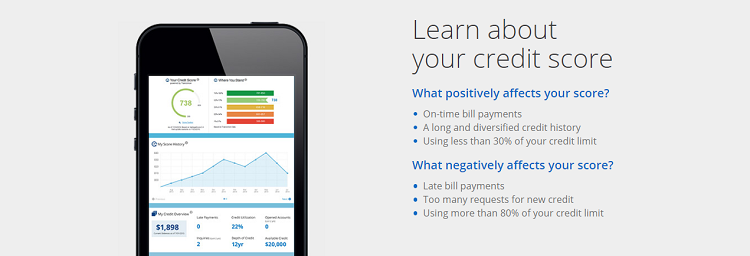

Doing this might lead to savings in interest, and it can also free up some space on your existing Chase card. Many cards come with 0% APR offers on balance transfers that stay in place for 12 to over 20 months. Bad thing is it is a Vantage Fako Score not a Fico based off of Transunion. If you wish to increase a Chase card’s credit limit to tap into more available credit on that particular card, you may also want to consider transferring its balance, partially or completely, to a balance transfer card. Chase Credit journey I dont know if anyone has posted this yet but Chase now has followed the likes of Discover where anyone can get a free credit score even non Chase customers. This will cause your credit score to drop by a few points in the short term, but if you handle your credit in a prudent manner, the impact will be temporary. Checking your credit score through Chase Credit Journey will not affect your credit score. Your score will refresh weekly, though you can check it whenever you want with no restrictions. A hard inquiry is when a lender pulls your credit report from one of the top three credit bureaus. Chase Credit Journey was launched in 2017 by Chase as a way for anybody not just Chase account-holders to check their credit score for free. When you request a credit limit increase, Chase may initiate a hard credit inquiry.

Depending on the specifics of your situation, you may receive Chase’s decision immediately, or you might have to wait for up to 30 days. This information helps Chase determine whether or not to approve your request. Expect to answer questions about why you want the increase, your existing financial situation, your current employment status and your creditworthiness. When you request a Chase credit limit increase, the customer service agent may ask questions about your finances. Or you may also call Chase Customer Service at 1-80. You may call the number on the back of your Chase credit card. You need to call Chase to request a credit limit increase because it does not accept online requests.

0 kommentar(er)

0 kommentar(er)